Round II:

Taxation

Overview

What are the factors driving tax formalization in developing countries? Could formalization trigger a chain of effects culminating in an increase in tax compliance?

Like tax compliance, a citizen’s decision to formalize his or her relation with the state seems to be the result of a comparison of the expected benefits of formalization to the expected costs. In the case of formalization, however, costs not only include future tax liability but, in many cases, include a costly and complex process. The Taxation Metaketa round seeks to answer these questions by implementing a series of research projects that assess the role of providing information about formalization on citizens’ intent to formalize and citizens’ formalization.

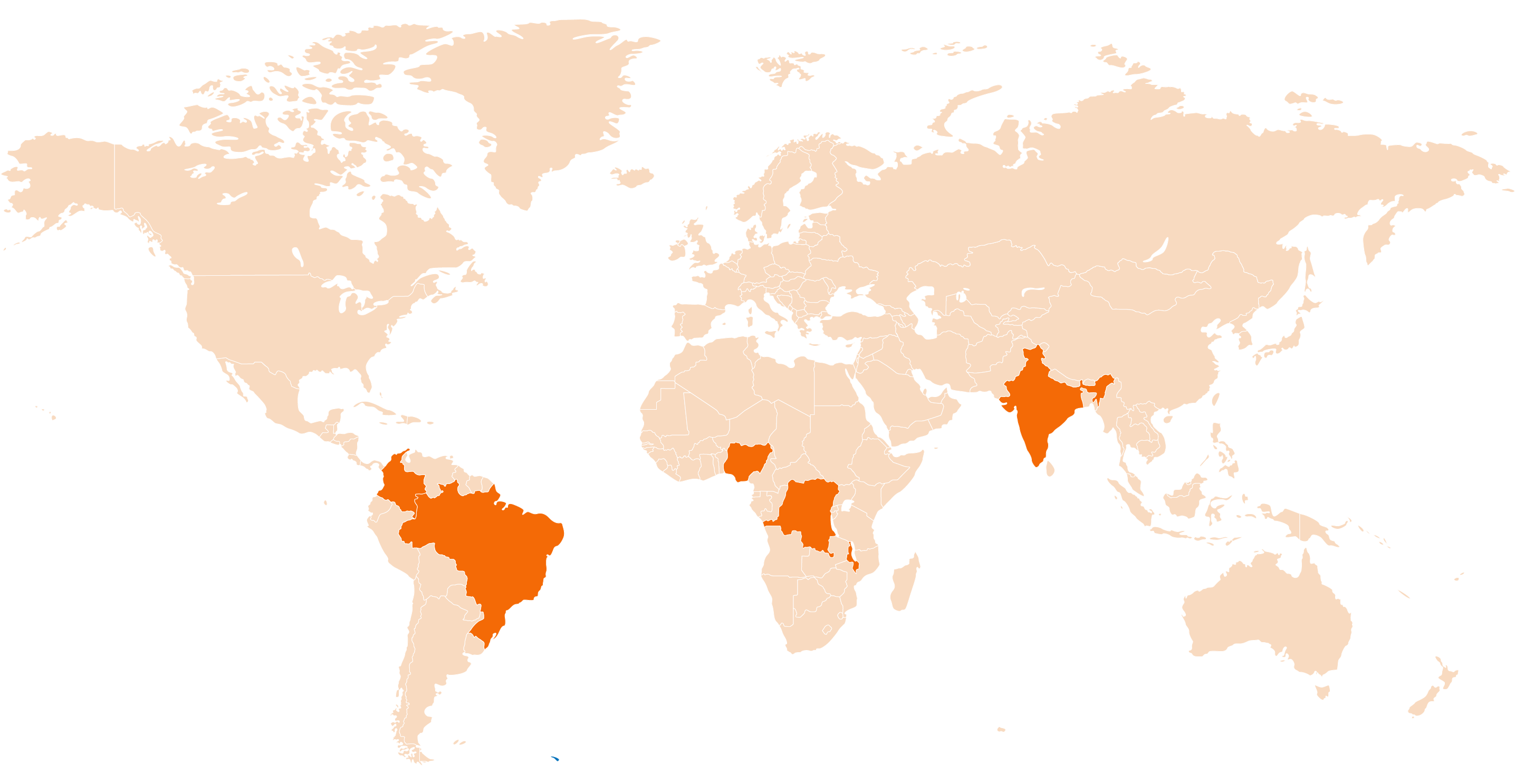

This Metaketa round was launched in Spring 2016 and will run until Spring 2020. This round awarded six projects—one each in Brazil, Colombia, DR Congo, India, Malawi, and Nigeria—ranging in funding from $150,000 to $250,000 provided by the UK’s Department for International Development. The studies in this Metaketa round aim to study the effects of common informational interventions, which combines information about the process of tax formalization as well as its benefits and costs with assistance and or subsidies to reduce the cost to citizens. In addition, each project will involve at least one complementary intervention.

Metaketa II Steering Committee:

Ana De La O (Chair, Yale University)

Don Green (Columbia University)

Peter John (University College London)